How the Senate can save hundreds of billions of dollars—and our grid—by truly terminating IRA subsidies

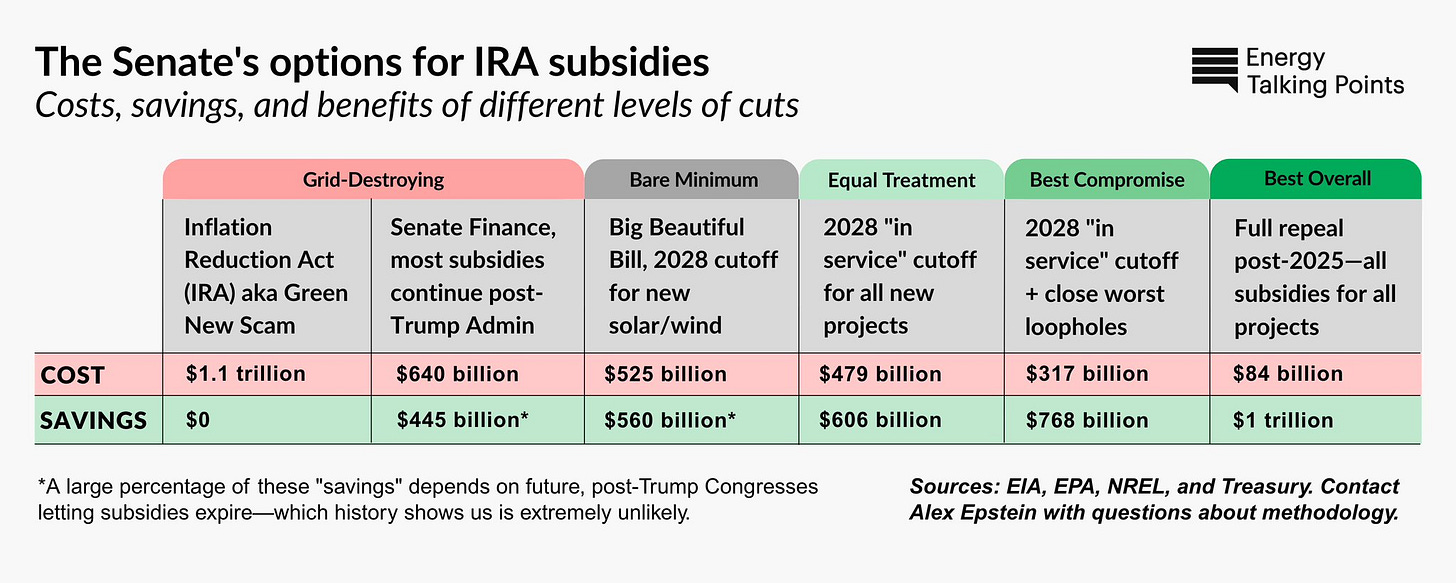

The Senate can save hundreds of billions of dollars—and our grid—by 1) terminating all IRA subsidies during Trump’s presidency and 2) closing the IRA’s worst loopholes.

Summary

The Senate can save hundreds of billions of dollars—and our grid—by 1) terminating all IRA subsidies during Trump’s presidency and 2) closing the IRA’s worst loopholes. The current Senate proposal is weak on savings and bad for the grid, but it can largely be fixed with some simple wording changes.

Key points

Republicans were right to run on “terminating” Inflation Reduction Act (IRA) subsidies, because these subsidies are destroying our grid, increasing the cost of energy, and increasing our debt.

The only way to truly “terminate” IRA subsidies as promised is to end eligibility during Trump’s term using a strict “placed in service” deadline.

Contrary to lobbyist lies, a strict eligibility deadline does not affect completed or near-completed projects.

While the House at least terminated new solar/wind subsidies using a 2028 “placed in service” deadline, Senate Finance’s proposal extends them indefinitely.

If the Senate applies the end-of-2028 eligibility deadline to all subsidies, it will fulfill its promise to terminate them—saving hundreds of billions in practice.

The Senate can save another $160 billion by closing the IRA’s most egregious loopholes, which lead to exorbitant overpayments to solar/wind/battery companies.

If compromises are needed for bill passage, they should be consistent with grid reliability—e.g., supporting nuclear without restoring solar/wind subsidies.

The IRA subsidies are destroying our grid, increasing the cost of energy, and increasing our debt

Subsidies for solar and wind are destroying our grid by defunding reliable power plants

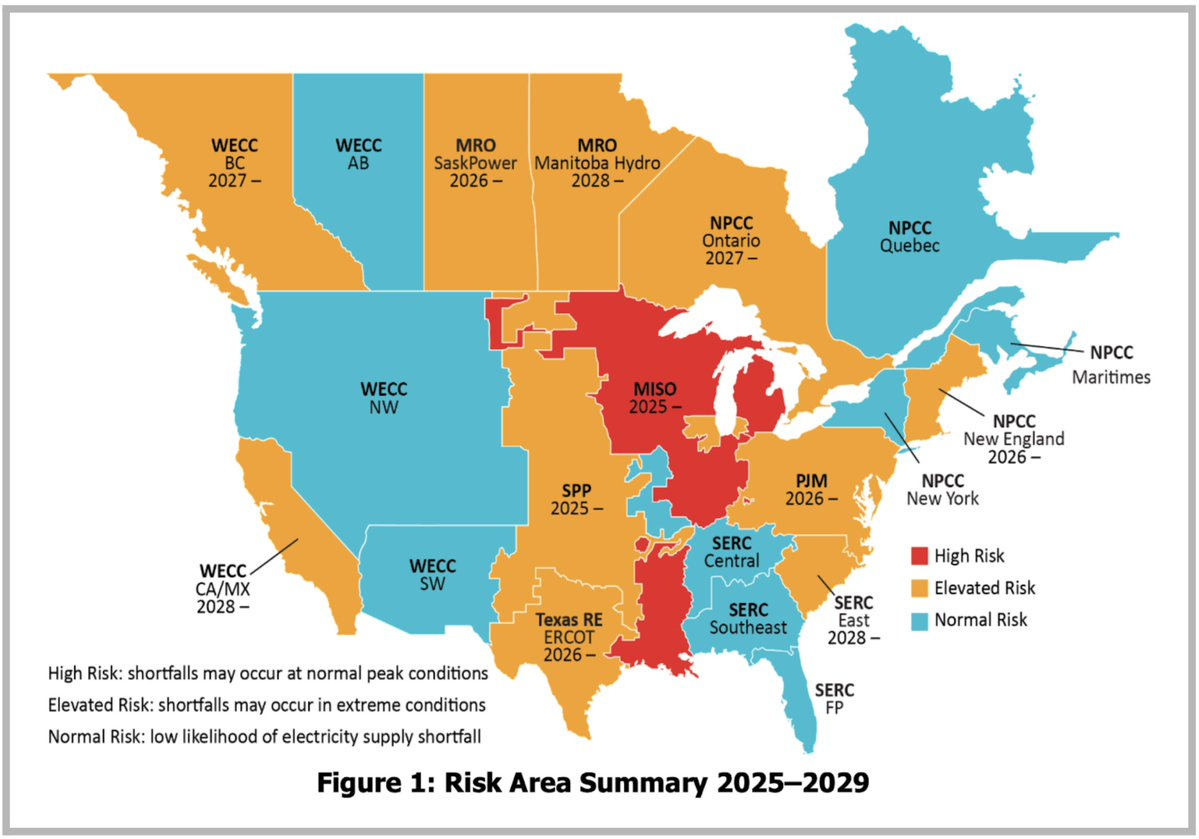

Our massive subsidization of solar and wind, which the IRA brought to new levels, has coincided with worsening reliability—see NERC’s long-term reliability assessment below—and difficulty bringing on new reliable power plants.1 This is no coincidence.

Subsidizing solar/wind harms the reliability of our grid by artificially flooding it with intermittent solar/wind generation that doesn’t itself provide reliable power—but takes away the electricity-market revenue reliable power plants need to be profitable.

The more subsidized solar and wind on the grid, the less time reliable power plants can operate profitably and thus the less revenue they get. Lack of revenue for reliable power has caused many reliable plants to shut down prematurely and has heavily discouraged the building of new reliable plants.

Energy Secretary Chris Wright this year called solar/wind subsidies “lunacy,” “a big mistake,” and “political posturing that results in higher costs and less reliable electricity.”2

At a time when we are seeing rapid new demand from AI data centers for reliable power,3 we need to stop subsidizing solar and wind as soon as possible so as to incentivize reliable generation as fast as possible, including: rapid upgrades of existing gas plants, new gas and oil generation, and even batteries where cost-effective.

All the IRA subsidies raise the price we pay for energy

While solar and wind subsidies are the worst IRA subsidies because they harm grid reliability, all IRA subsidies harm us by increasing the price we pay for energy.

All IRA subsidies involve taking money from taxpayers—including efficient energy producers—and giving it to companies to produce less efficient forms of energy. The result is always less efficient production and therefore higher costs.

When assessing the costs of subsidies, we must look at the total cost we pay for energy. For example if we’re subsidizing hydrogen fuel we must add the amount of the subsidy to the sticker price of the fuel. In all cases, subsidies make energy’s total cost—its real cost—higher.

With electricity, the cost of subsidies, dominated by solar and wind, is so large that even with hundreds of billions in subsidies paid in taxes/inflation, the sticker price of electricity has increased more than inflation—during a period when natural gas prices for electricity generation declined!4

How do solar and wind subsidies raise the sticker price of electricity? 1. Solar and wind proliferation requires massive backup costs—which show up in capacity markets, in battery costs, and in the need to replace the reliable power plants they have shut down. 2. They lead to massive transmission and distribution costs that are only necessary because of solar and wind.

The massive backup and transmission/distribution costs solar and wind impose are largely not covered by the subsidies we pay them. Those costs, which utilities incorporate in rate increases, get paid by ratepayers—while the solar and wind companies pocket the subsidies paid by taxpayers. Since most Americans are taxpayers and ratepayers, we get exploited twice.5

Subsidizing other forms of energy on top of solar and wind just adds more costs in taxes and inflation—at a time when we need the cheapest reliable electricity we can get.

Lobbyist myth: Getting rid of solar/wind subsidies will cause electricity prices to go up.

Truth: Getting rid of them is necessary to make electricity prices go down. Solar and wind subsidies have already caused total electricity prices to go up, along with imposing the far greater cost of a less reliable grid. (Remember that Texas electricity seemed cheap until Uri, when solar and wind were out to lunch but TX had spent 10s of billions of dollars on them instead of weatherizing its reliable power plants and having more of them.6) No matter what we do, subsidizing solar/wind, by defunding reliable generation, has already baked in more increases and reliability problems down the road. The only way to start lowering prices is to stop the subsidies now and get back to building truly low-cost, reliable generation.

All the IRA subsidies make our economy less productive

While subsidy-seekers like to talk of the investment and jobs the IRA subsidies have created, the IRA subsidies have created no net investment and jobs. Instead, they are expected to misallocate $3 trillion in private investment by 2032 and $11 trillion by 20507 into uncompetitive businesses and jobs. These huge investments would otherwise be channeled into truly productive businesses and jobs.

Lobbyist myth: The IRA has created valuable additional investment.

Truth: The IRA hasn’t led to obvious private investment growth and even if it did, additional investment into uncompetitive sectors isn’t valuable. According to the US Bureau of Economic analysis, total private quarterly net investment didn’t exhibit a discernible growth trend between Q2 2022 and Q4 2024. (It did jump in Q1 2025 but this is likely related to business’s optimism about Trump’s new term and not the IRA, which Trump’s initial EOs temporarily impeded.)8

Lobbyist myth: The IRA has created valuable new jobs.

Truth: The IRA has not resulted in higher employment.9 It is not creating new jobs, it is redistributing them to subsidy-driven, less-productive industries. This is particularly destructive where skilled laborers are being diverted from productive activities like building AI data centers.

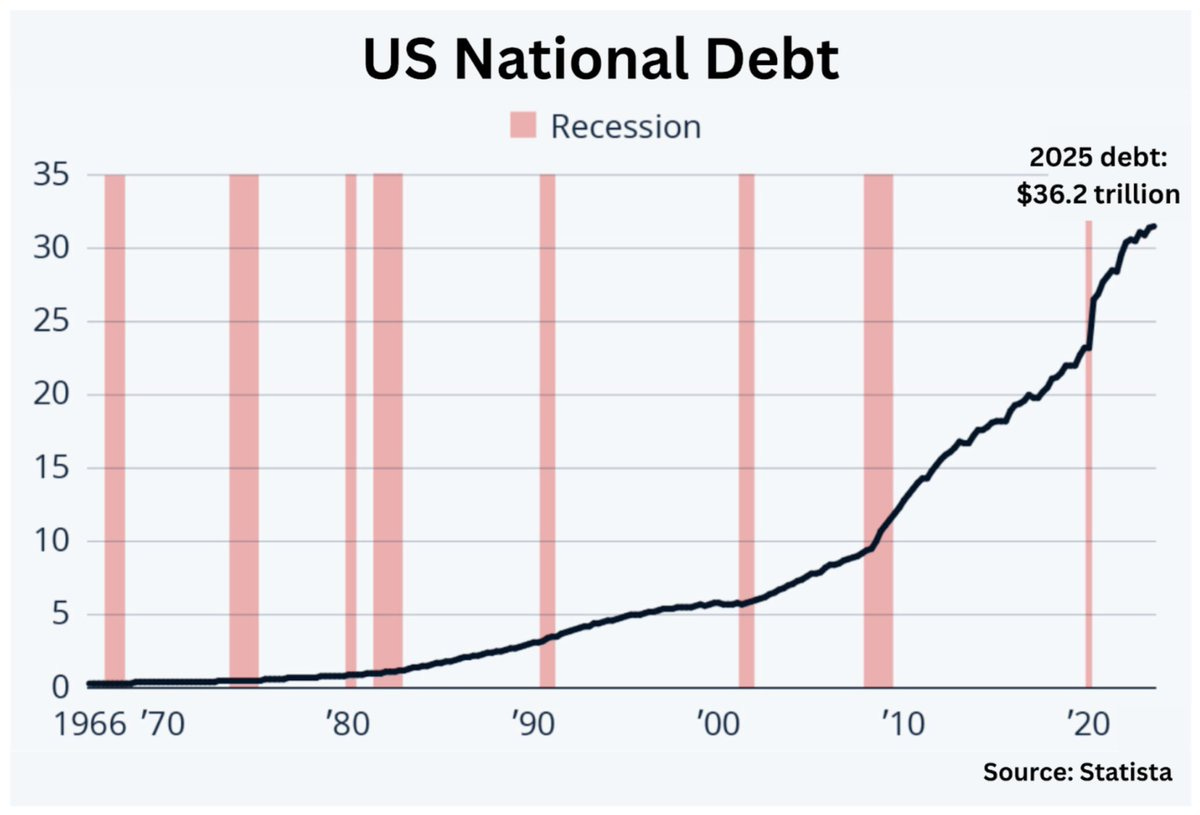

The IRA subsidies, as a multi-trillion-dollar liability, are a disaster for our precarious budget

Multiple credible estimates show the IRA costing over $1 trillion over the next decade. And given the IRA’s many loopholes, along with Congress’s tendency to continue entrenched subsidies, it will cost many trillions of dollars through 2050.10

At a time when America’s $36 trillion debt is undermining confidence in our currency, Congress cannot afford to leave trillions of dollars on the table—which is exactly what will happen if the IRA subsidies are not terminated within President Trump’s term.11

The only way to truly “terminate” IRA subsidies as promised is to end eligibility during Trump’s term using a strict “placed in service” deadline

“Terminating” the “Green New Deal” or “Green New Scam”—the IRA subsidies, which every Republican Senator voted against in 202212—was rightly a leading promise in the Republican platform and in President Trump’s campaign.13

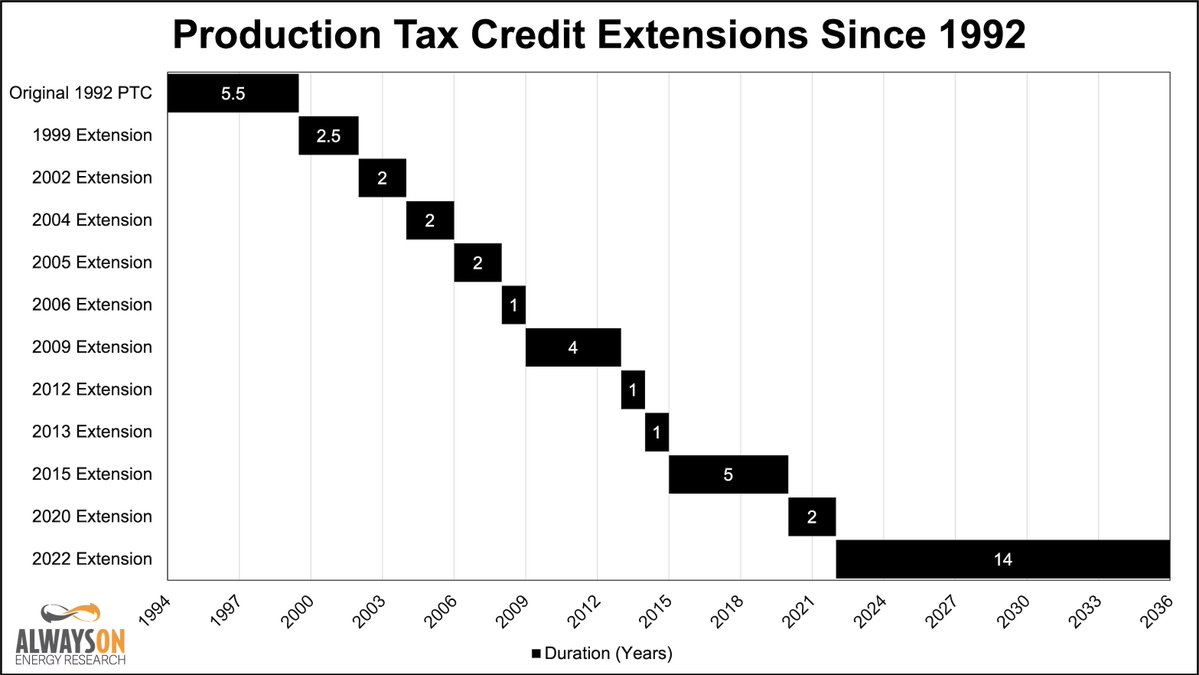

History shows us that it is difficult to truly terminate “green” subsidies; witness the Production Tax Credit (used mostly for wind) which has been extended for over 30 years since it was first passed in 1992!14

The only way this Congress and administration can truly terminate any IRA subsidies is to establish a strict eligibility deadline before the end of the Trump administration—a deadline after which no new project can start collecting subsidies, period.

The key to a strict eligibility deadline is for it to require that projects be “placed in service.” If an electricity project is not actually ready and available to produce electricity for customers by the deadline, it gets no subsidy, period.

The “placed in service” deadline should be as early as possible, but cannot be later than the end of 2028. End-of-2027, or even fiscal year 2028, would be much better.

In practice, an end-of-2028 “placed in service” eligibility deadline means that few projects started after 2026 will qualify for a subsidy—which will create a two year “subsidy drought” through the end of the Trump administration.

A subsidy drought prevents subsidies from easily being resurrected by 1) draining much of a subsidy’s massive lobby and 2) requiring any future subsidizers to pass new subsidies from scratch at a massive budget cost—instead of hiding them in the future baseline.

Contrary to lobbyist lies, a strict eligibility deadline does not affect completed or near-completed projects

While the House was totally within its rights to cut off all IRA subsidies, it grandfathered subsidies for all existing projects and ones that are reasonably close to completion.

Sadly, lobbyists are lying to Congress and the general public about this. E.g., solar/wind trade association CEOs have said “the House voted to immediately end the clean energy tax incentives,” “recklessly disrupting tax incentives will undermine projects that are ready to come online,” and “Hundreds of billions of dollars in local investments will vanish.”15

While the House at least terminated new solar/wind subsidies using a 2028 “placed in service” deadline, Senate Finance’s proposal extends them indefinitely

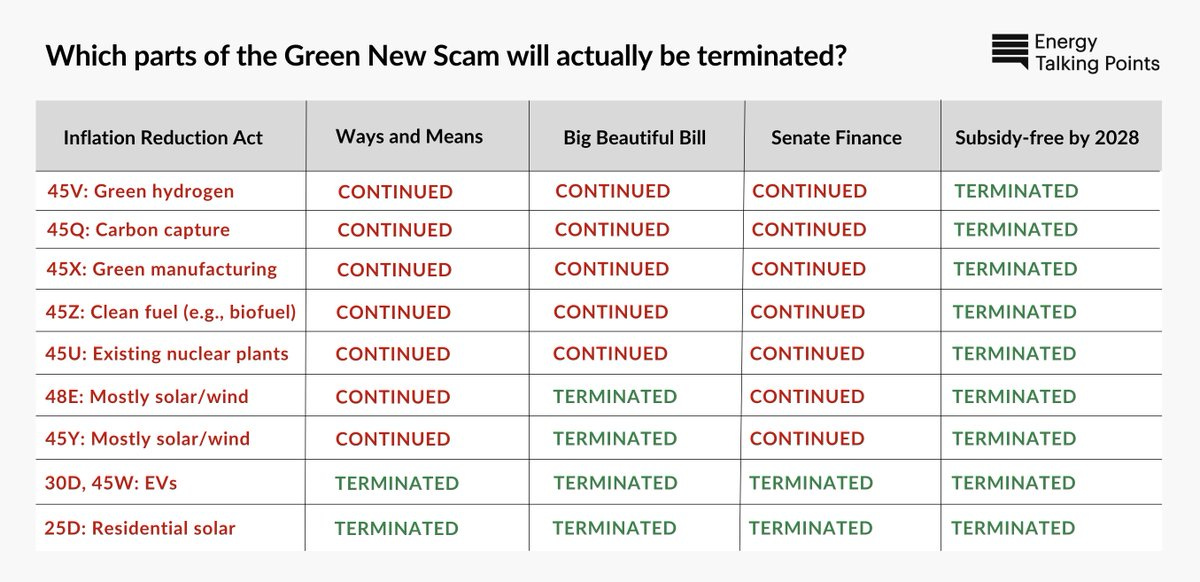

The final House bill crucially stopped subsidies for the vast majority of new solar and wind projects by cutting off subsidies to projects that were not “placed in service” by the end of 2028. The House BBB did not terminate 5 IRA subsidies.

Senate Finance’s proposal continues solar/wind subsidies indefinitely by removing the “placed in service” by 2028 deadline and using a “construction begins” pseudo-deadline.16

Lobbyists love “construction begins” by a certain “deadline” because they get 4 more bonus years of eligibility. E.g., a solar/wind developer can just put a small amount of money down (5%, most of it recoverable) and it gets 4 more years (a "safe harbor") to cash in the subsidy.

With the House’s 2028 “placed in service” deadline, new subsidized solar/wind projects would slow to a crawl by the end of 2026. But under Finance’s 2025-27 “construction begins” pseudo-deadline, which really means 2029-2031 (given the 4-year “safe harbor”) these new unreliable projects will spam our grid at least through 2031. Using the 10-year PTC, wind farms will still be collecting subsidies on President Trump’s 95th birthday in 2041!

This disaster for our grid is unfortunately the best-case scenario for Senate Finance’s proposal. Realistically, by extending eligibility for new subsidies well beyond President Trump’s term, the proposal makes it likely that future administrations and Congresses will extend solar and wind subsidies yet again—just as previous ones have done since 1994!

A cautionary note: don’t rely on the executive to restrict subsidies Congress won’t

Behind the scenes, some advocates of Senate Finance’s proposal are making two contradictory arguments to two different audiences. 1) To supporters of solar/wind subsidies: This proposal, by not imposing a “placed in service” termination, gives solar and wind companies the certainty they need to keep adding their needed electrons to the grid for years to come. 2) To opponents of solar/wind subsidies: This proposal will effectively terminate subsidies, even though as written it extends them, because the administration will engage in aggressive interpretations of the (FEOC) restrictions or “construction begins” provisions.

The obvious problem with these arguments is that those who make both of them are being disingenuous to get a deal done. The deeper problem is the proposal as written obviously isn’t clear enough about what subsidies it is terminating, and when. E.g., the reliance on 4-year “safe harbors” that allow you to say you’re stopping subsidies after 2027 when it’s really 2031.

For opponents of subsidies, extending the subsidies with confusing legislative text and then relying on the Administration to effectively terminate them is extremely high-risk because it necessarily relies on the Administration to interpret the law in a highly aggressive and therefore controversial way. This can easily fail due to multiple kinds of challenges.

Legal challenges: If the Administration interprets the law in a highly aggressive and controversial way, it will legitimately be subject to powerful legal challenges. E.g., if the IRS decides in 2026 that the definition of “construction begins” for a 2025 subsidy provision should be 4 times more aggressive than it was understood to be, it can (and should) be challenged.

Consistency challenges: Aggressive and controversial interpretations of the law can easily end up harming people the Administration doesn’t want to harm, which can cause them to pull back. E.g., Foreign Entity of Concern (FEOC) or “construction begins” provisions harming nuclear energy.

Constituency challenges: Aggressive and controversial interpretations of the law can legitimately anger important constituencies. E.g., if utilities are set to unexpectedly lose $50 billion due to an aggressive Treasury or IRS interpretation, they will rally all their resources to get that interpretation changed. This is far easier than winning the legislative battle subsidy-seekers are currently winning.

It is not ethical or reasonable to rely on the Administration to effectively cut subsidies that Congress explicitly extends. What this Administration can and should be relied upon to do is enforce a clear “placed in service” termination that occurs before President Trump leaves office.

A final note: Even under the most aggressive possible interpretations I’ve heard behind-the-scenes, the Senate Finance proposal will still enable large companies to get new subsidies for solar/wind well past President Trump’s term—a non-termination and a disaster for the grid.

If the Senate applies the end-of-2028 eligibility deadline to all subsidies, it will fulfill its promise to terminate them—saving hundreds of billions in practice

The only way to keep promises and save hundreds of billions of dollars short-term—and trillions long-term—is to apply an end-of-2028 eligibility deadline, at the latest, to all the IRA subsidies.

The end-of-2028 or earlier eligibility deadline should apply equally to all solar and wind subsidies, including residential solar—both purchases and leases. Both the House Ways and Means and Senate Finance proposals terminated residential solar almost immediately, while totally failing to terminate industrial solar and wind. The better and coherent policy is to terminate them all during this Administration with the same “placed in service” deadline.

While the House BBB will theoretically save (only) half of the IRA’s total cost over the next 10 years, in practice it will save even less unless tightened. Senate Finance’s proposal would save even less than that. All the subsidies that don’t terminate during the Trump Administration will likely be extended indefinitely by future Congresses facing even stronger subsidy lobbies.

In practice, setting an end-of-2028 eligibility deadline will ultimately save trillions of dollars compared to the House BBB and especially the Senate Finance proposal—because the subsidies will actually terminate.

The Senate can save another $160 billion by closing the IRA’s most egregious loopholes, which lead to exorbitant overpayments to solar/wind/battery companies

The IRA subsidies created and contained a level of exorbitant loopholes, especially for solar and wind, that is remarkable even for the loophole-prone world of subsidies. From indefensibly high subsidy levels, to the total absence of subsidy caps or declines (which any subsidy should have), there is a lot that can be fixed—and lead to great savings.

Cut 45X by 25% (it is currently set at inflated 2022 levels) and reduce it by 10% a year (to encourage innovation). 45X (green manufacturing) is supposed to incentivize efficient manufacturing of batteries, solar panel components, and wind turbine components. To do this it needs to be capped at a reasonably low price and decline over time. Currently 45X is based on inflated, supply-chain-crisis 2022 levels and does not decline. (Saves an additional $50 billion.)

Restore the ITC to pre-IRA levels. The ITC was supposed to, given the maturity of solar and wind, decrease to 10% by 2022. Instead the IRA added a number of provisions that increased it to 30+%. Paying 30% of a project’s cost is an astronomical subsidy. This is like the government paying you $15,000 to buy a $50,000 electric car. (Saves an additional $43 billion.)

Require all ITC subsidies to be based on cost, not “fair market value” that can inflate the subsidy to 75% of project cost. “Fair market value” allows a solar project that costs $100 million to claim a “fair market value” of $250 million and get a 30% tax credit of $75 million—75% of project cost! (Saves an additional $4 billion.)

No more PTC. After 2025, stop offering the PTC, which creates a 10-year subsidy stream that often amounts to 60-70% of project value, and is easily hidden during budgeting, and only have the ITC until 2028 (a one-time payment reduced to its pre-IRA level of 10% of project value). (Saves an additional $67 billion.)

If compromises are needed for bill passage, they should be consistent with grid reliability—e.g., supporting nuclear without restoring solar/wind subsidies

Full repeal is the ideal policy, but if compromises are necessary they should be pro-reliability and pro-fairness

In terms of the well-being of the country, including the budget and what is ethical, the best option is true and immediate full repeal—all subsidy eligibility and payments for all projects end after 2025.

If all subsidies for new and existing projects were terminated immediately, the grid would be better off (more investment in reliable sources, fewer reliable generator retirements, any needed solar/wind infrastructure would still be used) as would the economy (capital would flow toward truly productive projects and jobs). And it would be extremely difficult to bring subsidies back once they were totally off the books.

Lobbyist myth: We owe it to subsidized companies to continue subsidies because their investments depend on them. Truth: Companies have no legal or moral entitlement to continued subsidy payments, which they chose to rely on instead of creating truly productive businesses.

Lobbyist myth: Cutting subsidies creates dangerous “uncertainty.” Truth: We want to maximize uncertainty for those considering subsidy-dependent investments so that we get more real value creation. And for unreliable solar/wind projects that are actively destroying our grid, we want to maximize negative certainty.

I don’t know what compromises, if any, to the ideal policy of full termination of all IRA subsidies are necessary to get to a passable reconciliation bill. (Though I will note that not one of the subsidy supporters has committed to withhold their vote if subsidies are cut.) But I can say that the best compromises will be pro-reliability and pro-fairness.

Potential compromise: extended subsidies for nuclear (and possibly other dispatchable sources)

The Senate understandably has widespread support for nuclear energy, which is an ultra-reliable and clean source of electricity that was cost-competitive prior to crippling regulations, and that has exciting potential innovations such as Small Modular Reactors.

Because new nuclear shares certain subsidies with solar and wind—specifically the Production Tax Credit (PTC) and Investment Tax Credit (ITC)—some Senators have expressed concern that the House’s strict limits on these subsidies will be harmful for nuclear energy.

If the Senate wants to subsidize nuclear, it must disentangle nuclear subsidies from budget-busting and grid-destroying subsidies for non-dispatchable solar and wind.

One simple option is that the House bill can be simply modified to extend the ITC’s nuclear end-of-2028 “construction begins” deadline to an end-of-2034 deadline. It can also do the equivalent for geothermal and hydro (small budget items) if desired.

Potential compromise: align residential solar termination with other subsidy termination

Some observers have rightly pointed out that utility-scale solar has gotten wildly preferential treatment in various proposals compared to residential solar. For example, residential solar tax credits have repeatedly been slated for termination by the end of 2025, while utility-scale solar has been slated for termination by the end of 2028 at the earliest.17

Residential solar’s treatment doesn’t make sense re: budget cost (utility-scale solar is far greater) or jobs (residential solar proportionally involves more jobs), or fairness (residential tax credits are real tax credits deducted by real taxpayers, vs. transferable credits that otherwise unprofitable industrial solar businesses/divisions can exchange for cash—a true subsidy).

Insofar as Senators are compelled to compromise on anything related to solar and wind, the only remotely plausible option is to align residential solar termination dates with utility-scale solar (and wind) termination dates—so long as all are “placed in service” dates before the end of this administration. E.g., everyone’s subsidy gets terminated in 2027 or 2028.

The Senate Finance proposal includes several additional regressions from the House bill

The Senate Finance proposal exempts certain large solar projects on federal land from PTC “phaseouts.” These projects would be able to retain their eligibility for new subsidies even further out than 2031.

The Senate Finance proposal restores the green manufacturing (45X) phaseout back to 2032, regressing from the Big Beautiful Bill’s slightly accelerated 2031 sunset.

The Senate Finance proposal restores the existing nuclear (45U) sunset back to 2032, regressing from the Big Beautiful Bill’s slightly accelerated 2031 sunset.

The Senate Finance proposal restores full transferability of the tax credits that the Big Beautiful Bill curtailed. This would allow developers to continue to sell the credits to banks for their entire lifespan, letting banks monetize the full stream of taxpayer payments.

The Senate Finance proposal drops the road-use fees the Big Beautiful Bill introduced—$250 a year for electric vehicles and $100 for plug-in hybrids—even though these heavier cars now avoid paying fuel taxes and impose somewhat greater wear on roads.

Unfortunately, there are no ways in which the Senate Finance proposal strengthened the House bill’s modest IRA subsidy cuts. It only weakened or eliminated the House’s cuts. If not changed this will mean catastrophic and avoidable damage to our grid and our budget.

Detailed breakdown of costs, savings, and benefits of different IRA options

Michelle Hung, Steffen Henne, and Daniil Gorbatenko contributed to this piece.

Popular links

EnergyTalkingPoints.com: Hundreds of concise, powerful, well-referenced talking points on energy, environmental, and climate issues.

My new book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less.

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.