Why is gas so expensive in California?

Why do we in California pay $1.50–$2.00 more for gas than other states? It's simple: anti-freedom, anti-fossil-fuel policies.

This is the first post in a 5-part series about how to fix California’s energy problems. Today’s topic: How California is inflating gasoline prices.

Why do we in California pay $1.50–$2.00 more for gas than other states?

It’s simple: anti-freedom, anti-fossil-fuel policies:

High excise taxes

Cap-and-trade carbon tax

Reformulated Gasoline mandate

Low Carbon Fuel Standard

“Summer Blend” fuel requirements

1. CA’s excise tax on gasoline adds $0.60 per gallon to the price of gasoline.

Why: The excise tax is a direct per-gallon tax on gasoline, which is added at the pump and passed directly to consumers.12. CA’s “cap-and-trade” carbon tax adds $0.27 per gallon to the price of gasoline.

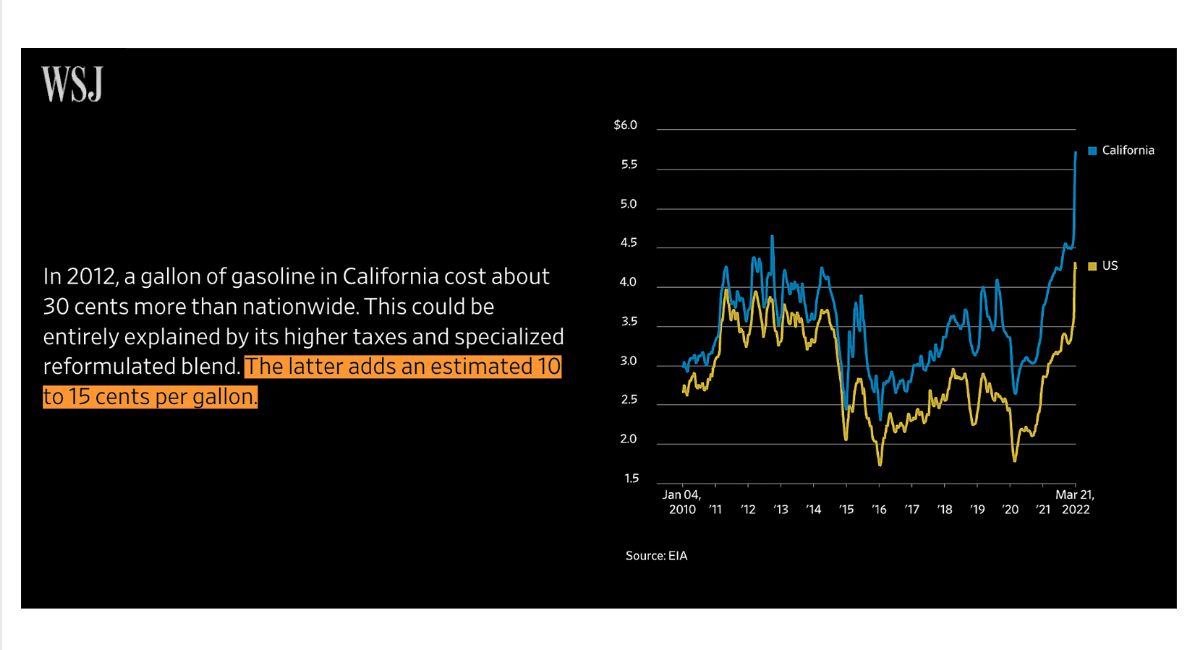

Why: The “cap-and-trade” program forces fuel suppliers to buy emissions allowances for every gallon of gas they sell. That extra cost is ultimately passed to consumers.23. CA’s Reformulated Gasoline mandate adds 10-15 cents per gallon to the price of gasoline.

Why: The California Reformulated Gasoline mandate requires the production and use of a unique blend of gasoline subject to strict requirements, making it more expensive to refine.34. CA’s Low Carbon Fuel Standard is projected to add $0.37 per gallon to the price of gasoline in the near term—and $1.15 by 2046!

Why: Low Carbon Fuel Standard forces fuel producers to buy credits to offset their fuel's carbon intensity, driving up costs that are ultimately passed to consumers.45. CA’s “Summer Blend” fuel requirements add up to $0.15 per gallon to the price of gasoline during warmer months.

Why: The “Summer Blend” requires refiners to use a costly, low-volatility formula that is more expensive to refine and distribute, leading to higher fuel prices.5The solution to California's gas prices is obvious: eliminate the 5 anti-fossil-fuel, anti-freedom policies that make prices so high.

Unfortunately, Governor Gavin Newsom wants to keep these policies and then scapegoat oil companies: “They've been fleecing you for decades and decades.”Californians, unite: tell Governor Gavin Newsom and other California officials to make driving affordable again by eliminating high excise taxes, the “cap-and-trade” carbon tax, the “Reformulated Gasoline” mandate, the “Low Carbon Fuel Standard,” and “Summer Blend” fuel requirements.

Michelle Hung, Daniil Gorbatenko, and Steffen Henne contributed to this piece.

Questions about this article? Ask AlexAI, my chatbot for energy and climate answers:

Popular links

EnergyTalkingPoints.com: Hundreds of concise, powerful, well-referenced talking points on energy, environmental, and climate issues.

My new book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less.

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

Alex you are a true gem. Keep educating the masses and one day soon we’ll tip the scales in favor of pro human flourishing energy policies 🤞🗽🇺🇸

It also does not help that they charge sales tax on gasoline that includes the cost of the other taxes, so you pay tax on your tax. From an AI "Therefore, the sales tax is calculated on the total price of gasoline, which includes the federal excise tax, state excise tax, and any other fees."

I always found this to be one of the more onerous practices of the state. Taxes on taxes. What a scam.